All regions of Spain

Online Consultations

+ (34) 633750044 via WhatsApp

Speak to an adviser

Mon - Sat 9.00 - 21.00

Sunday Closed

Discretionary fund management (DFM) services are available at Finance-Spain. These services are tailored to our more demanding and financially sophisticated clients with generally higher net worth. They offer investment strategies designed to individual needs and circumstances. Why 'discretionary'? Well, the fund manager and his team can change the individual investments within your portfolio at will - a vital tool in reacting quickly to market conditions and enabling the best overall performance. The manager will provide regular in-depth reports on the portfolio with detailed analysis of the market.

How are the investments structured?

The fund manager will have a recognised strategy for each type of client risk profile - usually from cautious, through balanced to more adventurous depending on the individual.

These actively managed portfolios can be held on the DFMs own platform of incorporated within a 'wrapper' for maximum tax mitigation - both capital gains and wealth tax. You can see more about this approach here.

We have seen that banks in the UK are now cutting their customers adrift if they are residents of Spain. This also applies to their discretionary fund management services. Furthermore if you have an independent financial adviser in the UK and you are not resident there, UK IFAs will no longer be able to passport their services to you after January lst 2021. Our advice is regulated and authorised within the EU and our parent group is registered with the Spanish authorities.

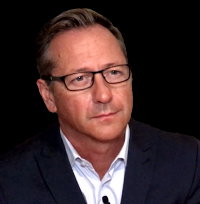

Patrick Macdonald ASCI

International Financial Adviser