All regions of Spain

Online Consultations

+ (34) 633750044 via WhatsApp

Speak to an adviser

Mon - Sat 9.00 - 21.00

Sunday Closed

Last Updated: Tuesday, December 03, 2024.

A QROPS is an international pension scheme for expat UK pension holders who wish to remove their pension from the UK. These plans are registered with HMRC and have to follow certain rules. They offer potential tax benefits and freedom from the UK pensions regime.

In 2006 the UK government finally gave in to pressure from the EU and started allowing anyone with a UK pension who planned on moving abroad to take that pension with them. This was known as 'A day' in the pensions world and formed part of a much wider reform of UK retirement rules. This is when the acronym QROPS was founded. It stands for 'qualifying recognised overseas pension scheme'. HMRC then published a list of companies and trustees who had declared themselves providers of QROPS pensions. This new type of pension could benefit those living in Spain. Although not 'approved' by HMRC as such these entities had to comply with certain rules set out in order to remain listed. Rules which broadly followed the UK pension regime. These rules have been tightened and refined over the years since 2006 resulting in a considerably reduced amount of providers as well as many jurisdictions (such as Australia and New Zealand) becoming largely inappropriate. Malta (EU) and Gibraltar are now the main countries where QROPS providers and trustees are located. It should be noted that the 'Q' is sometimes dropped by government and institutions and referred to as ROPS but they are one and the same.

So, fast forwarding to the modern era - here are the main points to consider when contemplating a potential transfer of your UK pension.

QROPS providers in Europe are usually in Malta as this is inside the European Economic Area (EEA) - a now defunct requirement to avoid the overseas transfer charge (OTC) if you also lived in an EEA country. Previously a transfer where the QROPS trustees were outside of this zone and/or the scheme member resided outside of this zone there would likely be a 25% transfer charge to HMRC. Now all transfers are subject the OTC unless the scheme member lives in the same COUNTRY as the QROPS provider.

In the past there were QROPS providers in New Zealand, Australia and The Channel Islands among other places. The main locations are now Malta and Gibraltar.

So why not Spain itself? Simply put, there are no institutions in Spain set up to receive and administer UK pension transfers.

Why Malta for Spanish residents then?

a) Malta has a strongly regulated and advanced financial services sector with all the main QROPS providers operating from there.

b) Malta has a dual tax treaty in place with Spain ensuring that tax cannot be paid twice.

c) With all UK schemes and QROPS, benefits cannot be taken before age 55 (accept in special circumstances such as severe ill health for example). However, Malta allows flexible

access to QROPS pensions post age 55 - meaning you can take as much as you want, when you want it (although one has to be mindful of potential tax implications in Spain).

Gibraltar may be alternatives for UK scheme members living in Spain who are younger than 55 but once benefits can be taken they do not offer the same tax efficiency.

To avoid UK inheritance tax. From 2027 UK pensions will be brought back into the UK inheritance tax (IHT) regime. However, IHT exposure will (from April 2025) be dependent upon the residency test rather than being UK domiciled. So if you have been non UK resident for 10 out of the last 20 years when you die, UK IHT will only apply to your UK based assets. A QROPS is not a UK based pension and therefore would be free from UK IHT at 40%. So if you have a large pension and you wish to leave it for your children or other non spousal beneficiaries it may be worth considering taking the 'hit' of the Overseas Transfer Charge of 25% rather than 40% IHT on death.

To help with divorce and creditor proofing. A UK court can order pension funds to be handed over or shared. This is much harder with a QROPS where the UK court has no jurisdiction. Again it may be worth paying the 25% OTC in these circumstances.

To combat the effects of Brexit. Increasing numbers of UK pension providers are forcing members who are living outside the UK at retirement benefit age (55) to either buy an annuity (restrictive and poor value - nothing to pass on to spouse/partner or beneficiaries) or transfer to a QROPS or International SIPP.

To mitigate currency risk. You can choose to have your overseas pension in Euros thereby avoiding future fluctuations in the exchange rate. You can also keep it in Sterling or have a mixture of both.

Because Spain recognises EU pensions. Following changes to EU law, Spain is more likely to view a QROPS as a personal pension (rather than a personal investment. Personal pensions in the UK do not fall under this classification anymore.

To avoid UK Lifetime Allowance charges. There are no lifetime allowance restrictions with a QROPS. Important to note that the UK government abolished the LTA from April 2023. HOWEVER the Labour party did pledge to bring it back. It appears those plans are on hold for now but this could change.

To get 'Flexible Access' - post age 55 take what you want, when you want it. No capped draw down restrictions - though this is the same with an International SIPP.

To obtain a larger lump sum of 30% free from UK tax.

To benefit from EU based financial advice. Using an adviser familiar with the Spanish system combined with a QROPS will make it easier to keep track of tax and regulation changes in your country of residence.

Without warning in the October 2024 budget the UK government announced that they were abolishing the EEA rule for QROPS transfers. This now means

that if your pension is not in the same country (rather than just inside the EEA) where you live, it will be subject to

the 25% Overseas Transfer Charge - making an International SIPP an even more attractive option.

The 5 year rule is in relation to the QROPS plan holder. During the first 5 years of UK non residency the member may not be able to enjoy the full benefits such as the 30% tax free lump sum. Although there is a 10 year HMRC reporting period from the QROPS provider you are free from any UK tax rules after 5 years of non UK residency.

Should you return to the UK the pension will be treated the same as a UK pension and taxed as such.

Well, it was the EU who essentially forced the UK (due to freedom of services and movement) to allow UK residents leaving the country to take their pensions with them. Since Brexit the UK has been able to modify the law relating to QROPS to make it more and more restrictive.

Anyone with a UK pension living or planning to live abroad.

Members of UK personal/private pension schemes.

Members of company schemes including defined contribution and (in some cases) defined benefit (DB or final salary) schemes.

When the pension is an annuity.

When the pension is a defined benefit (final salary) scheme ALREADY in payment.

If it is the UK state pension.

When the pension is a NHS/MOD/Police or teacher DB scheme.

As mentioned above, there are still some circumstances where a transfer to QROPS could be advantageous so for a free, no obligation assessment of your own circumstances and further information please call us on 951 390 201.

We are part of a reputable international financial management group. The group holds the requisite license to give investment advice on pensions under the EU Mifid 11 directive. This is important as other firms will charge you extra as they have to outsource this area of advice. We do not.

We are not a data broker passing your information on to other firms etc. We are licensed and authorised throughout Europe to give financial advice and arrange pension transfers. When you call us you will speak directly with the qualified, experienced adviser who will assess your pension(s) and give you a personal recommendation bespoke to your circumstances. You are under no obligation to follow our recommendation and we do not charge for your pension evaluation. So, for an initial chat why not give us a call or send a message on the form below. REMEMBER avoid scammers by only dealing with properly regulated entities.

We are British advisers living in Spain with the appropriate qualifications and experience to give professional advice here. Unlike UK based firms we have a deep knowledge of the pension laws and tax system in Spain.

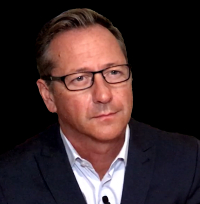

Patrick Macdonald ASCI

International Financial Adviser

Living and advising in Spain for 14 years